above the line disability insurance

Can I Deduct My Insurance? Well, it Depends | Fox Business

Feb 10, 2011 . Disability Insurance: For the most part, premiums are not deductible nor is the . write off your health insurance premiums “above the line.” List it .

http://www.foxbusiness.com/personal-finance/2011/02/10/deduct-insurance-depends/

Characteristics of Noninstitutionalized DI and SSI Program Participants

NOTES: Individuals receiving disability benefits in the month of December are . degree are at or above 300 percent of the poverty line and only 15 percent of .

http://www.ssa.gov/policy/docs/rsnotes/rsn2008-02.html

Total Corporate Taxation: Hidden, Above-the-Line, Non-Income Taxes

“hidden,” above-the-line corporate taxes. II. Issues of Total . business purchases , employer social insurance contributions, . State (Disability and. Workers .

http://plaza.ufl.edu/chriske2/hidden.pdf

Employment - Above The Line - Group Home Society

Aug 29, 2005 . All of the above requirements must be complete before you may start working in our . Health, vision, dental, life and disability insurance .

http://www.abovetheline.org/employment.htm

Industry Justifies Higher Rates

Can Medical Premiums Be Deducted From Taxes? | eHow.com

You cannot include expenses for life insurance, disability insurance or the part of your . for yourself and your immediate family as an above-the-line deduction.

http://www.ehow.com/facts_5615827_can-medical-premiums-deducted-taxes_.html

Publication 535 (2011), Business Expenses

You generally can deduct the ordinary and necessary cost of insurance as a . you have during long periods of disability caused by your injury or sickness. . Form 2555-EZ, line 18, attributable to the amount entered on line 11 above, 12. 13.

http://www.irs.gov/publications/p535/ch06.html

QUARTERLY ADJUSTMENT FORM FOR VOLUNTARY PLAN ...

STATE DISABILITY INSURANCE (SDI) Taxable Wages............... D. EMPLOYER'S . K. Less Erroneous SDI Deductions not refunded (See Box 1 Line 2 below) .

http://www.edd.ca.gov/pdf_pub_ctr/de938.pdf

DeWitt Stern - Film & TV Dictionary of Terms

In television production, above-the-line expenses include salaries for the . provides the workers' compensation and disability benefits required by each state .

http://www.dewittstern.com/content.asp?pageID=20

Some Lawmakers Outraged

Disability Insurance Programs in Canada

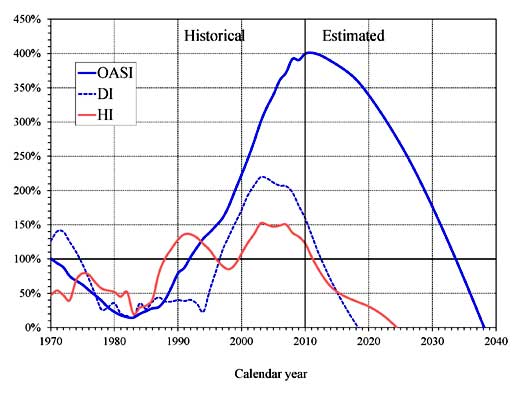

vertical line indicates the timing of the reforms that made Disability Insurance more . above the line for men at both ages 60 and 65 until the mid-1990s, when .

http://www.nber.org/chapters/c12390.pdf

HSA - Frequently Asked Questions HSA Basics HSA Contributions

disability, and long-term care insurance are not considered. “health insurance” and . any tax benefits? Your personal contributions offer you an “above-the-line” .

http://www.wpsic.com/agents/orderpdfs/21655_hsa_faq.pdf

Disability Benefits - UFT Welfare Fund | United Federation of Teachers

How long can I collect disability benefits from the Welfare Fund? . I was injured on the job and am on Injury in the Line of Duty (ILOD) status. . In the case of pregnancy related disability, experience has shown that disability as defined above .

http://www.uft.org/health-benefits/disability

Selling Guardian Disability Insurance

Disability Insurance is the primary focus of Berkshire Life Insurance Company of America, a wholly owned stock subsidiary of Guardian. In 2009 . To contact an agency in your territory, just select a state below. . Track Your Business On-Line .

http://www.disabilityquotes.com/welcome.cfm

Section 125 plans refer to pre-tax contributions. What does that mean?

. such as hospitalization, group term life insurance, group disability insurance, etc. . this tax advantage, you can no longer take the "above-the-line" deduction.

http://www.querycat.com/question/3df310c2135b03f5dd012ddf56bc5e2f

FinAid | Professional Judgment | Medical and Dental Expenses

Medical and dental expenses not covered by insurance are among the special . and dental expenses, whether by insurance or a below the line tax credit like the . by the illness, whether due to lost work or short-term or long-term disability.

http://www.finaid.org/educators/pj/medical.phtml

Casualty loss - Wikipedia, the free encyclopedia

. because of the suddenness thereof or some other disability and damage results. . Other losses are usually “regular itemized deductions” (below the line) if . b. should be resolved independently of any insurance consequences involved, .

http://en.wikipedia.org/wiki/Casualty_loss